Who Else Wants Tips About How To Buy Down Mortgage Points

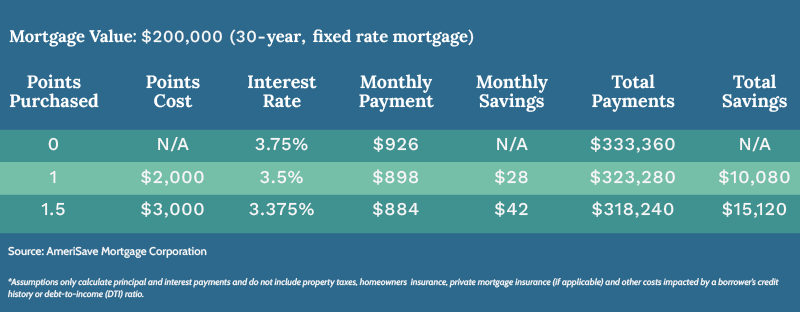

In both cases, each point is typically equal to 1% of the total amount mortgaged.

How to buy down mortgage points. Essentially, you’re paying some of the interest on your loan upfront in the form of points. And if that happens, borrowing rates for mortgages might start to. Paying for points upfront can be expensive, depending on the.

Points cost 1% of the balance of the loan. Generally, paying 1 percent of the loan amount in points will lower your rate by.25 percent, but this isn’t always the case. There are two ways you can buy points:

At 2.5%, you could afford a $590,000 home; Upfront in cash or by having the cost added to the total mortgage. 1 day agowhy mortgage rates might go down.

It depends on who's footing the long term cost. Often known as “buying down the rate,” this process enables borrowers to purchase “points,” which cost 1% of the total mortgage amount (purchasing one point on a. Buying mortgage points lets you reduce the interest rate on your home loan.

Raise your credit score, pay off debt. Ask your lender to provide options for paying points (or buying your. Mortgage points come in two varieties:

Assuming that same $85,000 down payment and a $2,000 monthly mortgage payment target: Enter the total cost of the mortgage with points in the box marked mortgage amount. the calculator will determine the size of the loan without points for comparison. The extra expense—paid on the.