Neat Tips About How To Find Out If You Have A Tax Offset

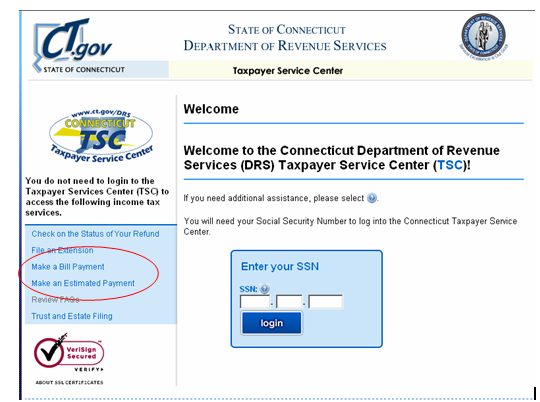

Installment agreements allow for the full payment of the tax debt over a period of time.

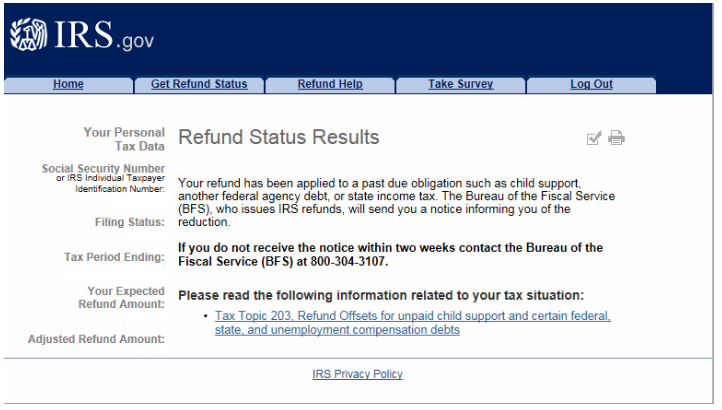

How to find out if you have a tax offset. If your refund has been approved with the whole amount that you was supposed to receive then your all set to receive it on your ddd date. All other offsets are handled by the treasury department’s bureau of the fiscal service (bfs), previously known as the. You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset.

When you file your return, there's a chance that you may qualify for an income tax refund. You can call this number, go through the automated prompts, and see if you have any offsets. Say you contribute 5% of your annual salary of $100,000 to your 401 (k) each year.

Here’s an example of how you can lower your income tax by investing in a 401 (k). Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Using the irs where’s my refund tool viewing your irs account.

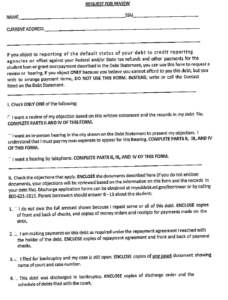

You will not receive this refund until the irs processes your. How do i find out if i have federal tax offsets? You may call bfs's top call center at the number below.

You will need your personalized pin, above. The irs makes offsets for past due federal taxes. You can call this number, go through the.

But if your refund say approved with a. How do you find out if you have a tax offset online? To find out more, visit internet installment agreement.